Introduction

In the ever-evolving landscape of the health insurance industry, it is essential for insurance companies to keep up with the latest technological advancements to streamline their processes and provide better service to their clients. One such technology that has gained tremendous popularity in recent years is PPG (Photoplethysmography) solutions. PPG has emerged as a valuable tool in health insurance underwriting, offering numerous advantages that can greatly benefit insurers. In this article, we will explore the potential of PPG in streamlining health insurance underwriting, focusing on the advantages it brings to insurance companies and how Vastmindz is leading the way with Insurance Companies to help them improve the Health Insurance Underwriting process.

PPG Solutions in Underwriting

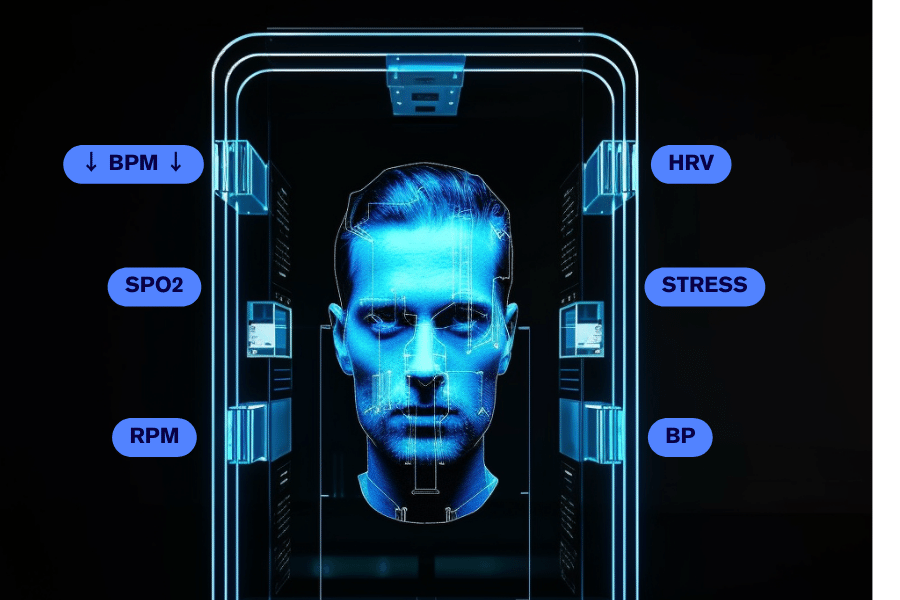

PPG solutions play a crucial role in health insurance underwriting by providing insurers with valuable data and insights into the health status of potential policyholders. By analysing the PPG signals obtained from a simple selfie scan using a phone, insurers can gather comprehensive information about an individual’s heart rate, blood pressure, oxygen saturation levels, and other vital signs. This data can be used to assess the overall health of the applicant and make informed decisions regarding their insurance coverage and optimising the onboarding process.

One of the key applications of PPG in underwriting is the assessment of an individual’s cardiovascular health. By monitoring the pulse waveform and analysing the PPG signal, insurers can gain valuable insights into the applicant’s heart health. Abnormalities in the pulse waveform can indicate underlying cardiovascular conditions, and early detection of such conditions can help insurers tailor insurance policies to meet the specific needs of the individual while managing potential risks.

Another important aspect of PPG solutions in underwriting is the assessment of physical activity and lifestyle habits. By continuously monitoring the PPG signals, insurers can gain insights into an individual’s exercise patterns, sleep quality, stress levels, and overall lifestyle. This information can help insurance companies design personalised policies that incentivise healthy behaviors and reduce the risk of future health complications.

PPG Underwriting Advantages

The integration of PPG solutions in health insurance underwriting brings several advantages for insurance companies. These advantages not only streamline the underwriting process but also enable insurers to offer more personalised coverage to their clients.

Health Insurance Underwriting at scale using a mobile

1. Enhanced Risk Assessment

By incorporating PPG data into the underwriting process, insurers gain a more comprehensive understanding of an individual’s health profile. This enables them to assess the risk associated with insuring that individual more accurately. The data obtained from PPG signals can help identify potential health risks, such as pre-existing conditions or undiagnosed cardiovascular problems, allowing insurers to tailor policies that adequately cover these risks.

2. Improved Underwriting Efficiency

Traditional underwriting processes often rely on lengthy medical examinations and extensive paperwork, which can be time-consuming and labor-intensive. PPG solutions from Vastmindz offer a more efficient alternative by automating and digitising the data collection process. Insurance companies can receive real-time data from applicants, eliminating the need for manual data entry and reducing the time required for underwriting. This streamlines the entire process, allowing insurers to provide faster response times and enhanced customer experience.

3. Personalised Insurance Policies

By leveraging the insights gained from PPG data, insurance companies can design personalized insurance policies that align with the specific needs and health profiles of their clients. Instead of offering standard coverage, insurers can tailor the coverage based on an individual’s health metrics and lifestyle habits. This personalised approach not only improves customer satisfaction but also helps insurers mitigate risks and manage claims more effectively.

4. Encouraging Healthy Behaviours

PPG solutions provide insurers with the ability to capture a snap shot of health data from a person with ease. Insurance companies can leverage this data to promote healthy behaviours among their policyholders. By offering incentives, such as premium discounts or rewards, to individuals who maintain an active and healthy lifestyle, insurers can encourage their clients to adopt and sustain healthy practices. This proactive approach benefits both the policyholder, who enjoys improved health outcomes, and the insurer, who reduces the likelihood of large claims.

Health Insurance Underwriting

Health insurance underwriting is a critical process in the insurance industry, involving the assessment of risk factors associated with individuals seeking insurance coverage. Underwriters evaluate various factors, such as age, medical history, lifestyle habits, and pre-existing conditions, to determine the premiums and coverage options for applicants. Traditionally, this process has relied heavily on medical examinations and historical data, often leading to delays and subjective evaluations.

However, with the advent of emerging technologies like PPG, health insurance underwriting is undergoing a transformative shift. The integration of PPG solutions allows insurers to leverage real-time health data and gain valuable insights into the overall health status and lifestyle habits of applicants. This data-driven approach enhances the accuracy and efficiency of risk assessment and enables insurers to offer more personalized coverage options.

Conclusion

The potential of PPG in streamlining health insurance underwriting is immense. As insurance companies strive to provide better services and cater to the evolving needs of their clients, incorporating PPG solutions into their underwriting processes is a strategic move. By leveraging the advantages offered by PPG, insurers can enhance risk assessment, improve underwriting efficiency, offer personalised insurance policies, and encourage healthy behaviors among their policyholders. Embracing PPG technology not only streamlines operations but also leads to enhanced customer satisfaction and better management of risks for insurance companies in the increasingly competitive health insurance market. To book a demo on how Vastmindz technology can help enhance the underwriting process, get in touch.